Some considerations about Bitcoin on-chain network fees

When avoiding on-chain transactions is better and what are the possibilities we can take

Inscriptions are often referred as spam and they are charging high load in the mempool, causing raising of network fees and congestion. This, as we know, impacts on what we usually pay when doing a standard day-to-day on-chain transaction.

Many people think inscriptions are spam and therefore something that would need to be fought against, while some other people think this is a standard usage of the space inside the Bitcoin time chain and represents a legitimate usage.

What is sure is that standard transactions become more and more expensive and this introduces additional challenges especially for people who are not very skilled or so much familiar with Bitcoin mechanics and layers above the first.

In this article i pointing out some details to consider when making transactions, in order to take the right decision.

When to transact on-chain?

First of all. Transact on-chain only when really needed and for a relatively high value payment. Small value on-chain transactions should be avoided in the most of cases. Infact in this case the impact of miner fees on the total amount can be significant, being the miner fee just depending on the size (in bytes) of the transaction. On my opinion, on-chain transacting for less of 2M Sats is not a good idea. For smaller transactions like 50’000 or 300’000 or 1 M Sats, just use Lightning which is simple, cheap and effective and just works.

Can Liquid Bitcoin help?

For higher transactions or for accumulating and hodling purposes, you can also consider to purchase using Liquid. Liquid Bitcoin, which runs on a Bitcoin side-chain (managed by federated entities), can allow accumulating temporarily bitcoin until reached a certain amount that is worth going back on-chain (Bitcoin layer1).

This can be done, for example, using Liquid Vouchers and can be a good solution, which obviously presents trade-off but that can be worth considering. Many people are already using this way. Moreover there are everyday new tools supporting Liquid, like Green, Marina Wallet or Aqua. Understanding the concept of “federation” in Liquid is crucial, in order to figure out what is Liquid and why the transactions efficiency in Liquid is so high while the fee cost is so cheap.

Transact small quantities using Lightning

If you want to issue small quantities of Lightning Sats, instead, you can consider the possibility to use credits and self issue Vouchers whenever you prefer, with the minimum possible amount of fees.

In order to use Lightning you can use custodial tools like: Wallet of Satoshi (WOS), Alby, Satsmobi, etc. ore use non-custodial ones like: Phoenix, Breez, etc. Obviously non custodial Lightning wallets need the user to understand what a channel is and what are the fees involved in a channel to open, for example. Infact these solutions are concerned with different kind of fees to be paid: opening/closing channels events, LN/OC Swap, slicing, etc.

Becoming familiar with Swap tools is also now quite mandatory. A wise Bitcoin hodler and user may face the need to often swap between first and second layer or crossly to Liquid sidechain.

Small considerations for preparing an on-chain transaction

If, finally, you need to make a transaction on-chain, consider doing the following:

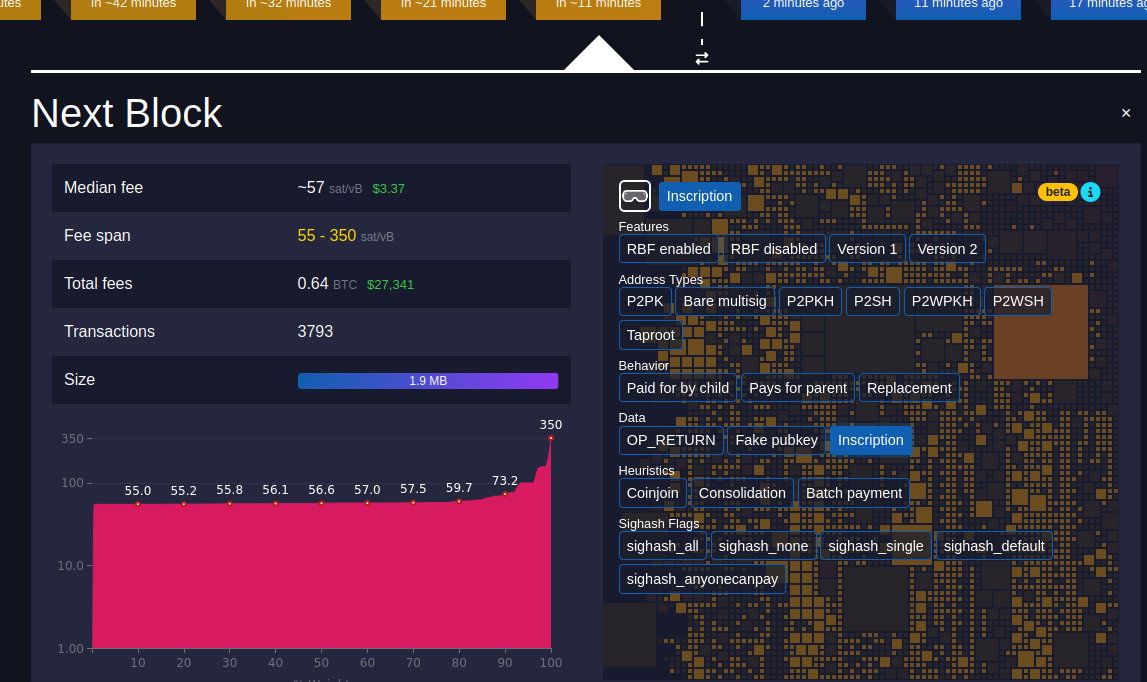

Checkout the actual status of the mempool before broadcasting a new transaction;

Consolidate wherever possible your UTXOs when fees are lower (however be sure to understand privacy implications);

Monitor using tools like mempool.space in order to find the best mempool status to receive your transaction. It’s useful also to see the time elapsed from previous mined block, the composition of first candidate block (how many inscriptions transactions are in, op_return, etc). There is a new tool of mempool.space named goggles which is useful to make such analysis and take due considerations and decisions;

Avoid small little transactions and prefer a single transaction with higher amounts. Moreover the fee will be lower if a smaller number of Inputs and Output are involved in such a transaction;

In case the transaction is an open channel transaction, you should open a large channel rather than many smaller ones and choose the right moment where a lower fee is shown on mempool analysis tools;

I hope to have provided a good bunch of suggestions that can be useful for correctly manage your UTXOs and decide the best moment to make on-chain transactions.

thanks Massimo, If ever you want to do an article on Ordinals, that would interest me. Like where and how we can view the actual jpeg. they are selling for a lot, like this article. https://cryptonews.com/news/bitcoin-ordinals-genesis-cat-sells-for-254k-in-sothebys-digital-art-auction.htm

It might be interesting to compare it to past fads or to ethereum ordinals.

also maybe an article on how to actually get started with Liquid. I have never used it